Commercial buildings increase more than 100% in value in three years

Commercial buildings increase more than 100% in value in three years

**This story has been updated from its original version to include the response from the MRC** 02.08

Owners of commercial buildings in the Pontiac, but particularly in Fort-Coulonge, were surprised by the new assessment roll, which saw some properties jump in valuation by several hundred thousand dollars and even more than double their assessment in three years

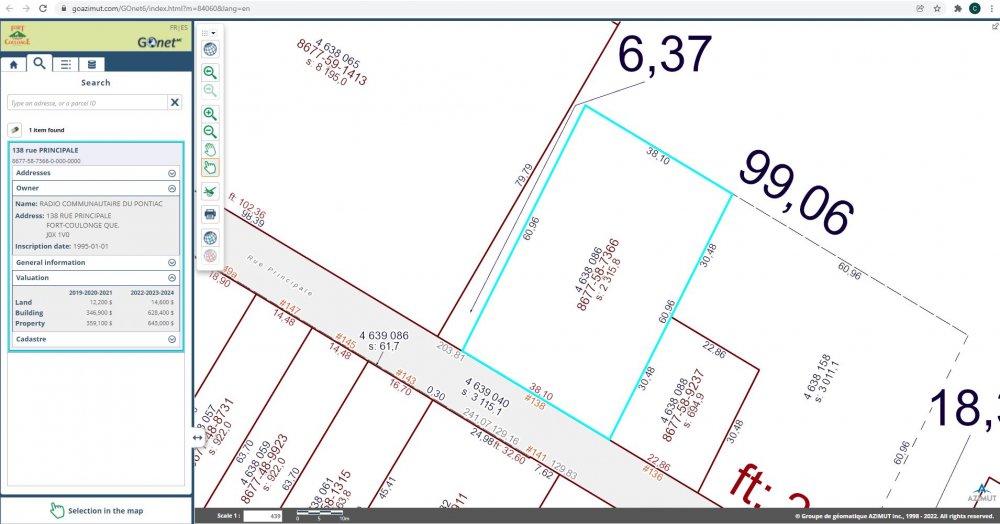

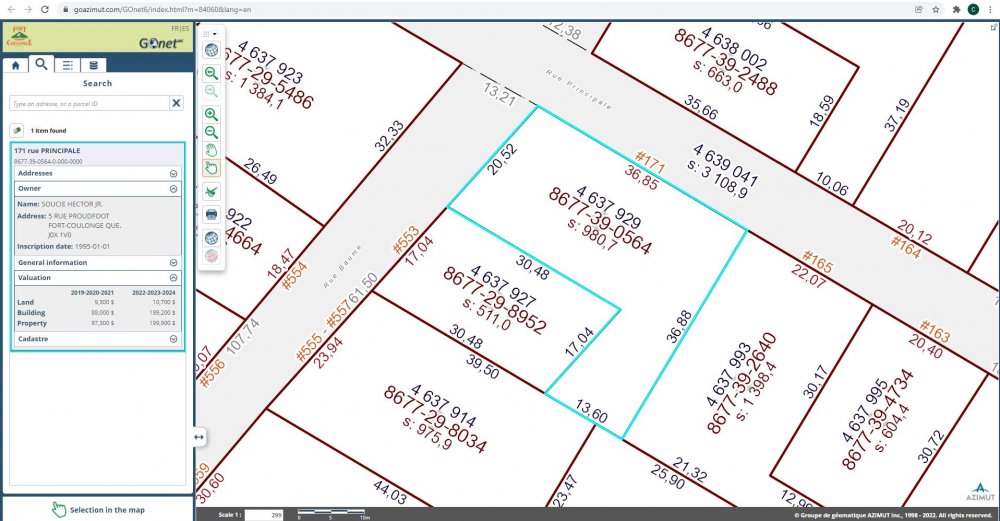

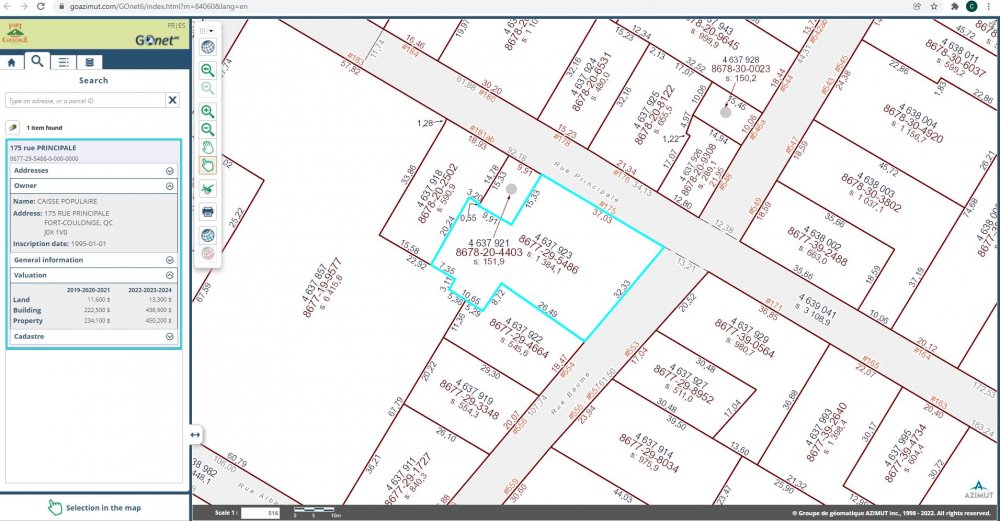

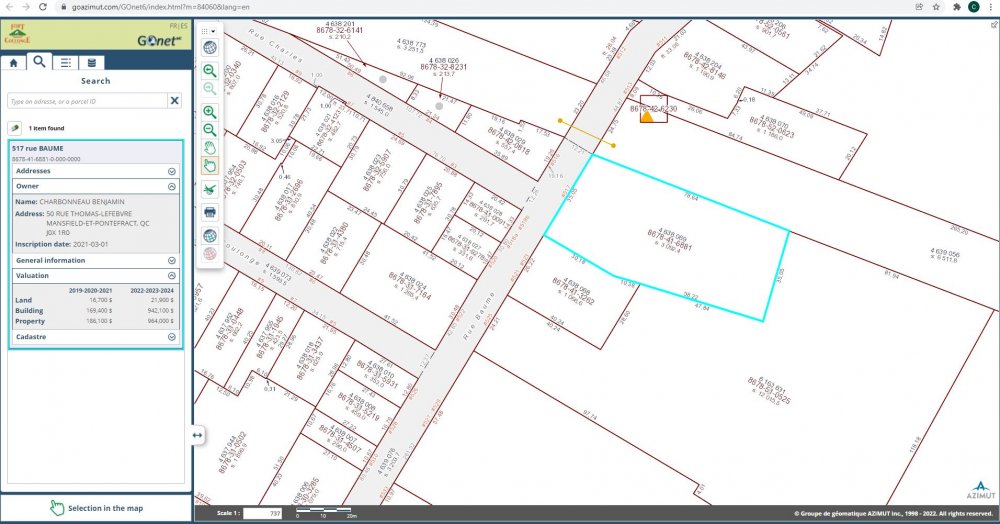

According to the graphic matrix available through a link on the MRC Pontiac website, the value of the building that currently houses the Caisse Desjardins has increased from $234,100 to $450,200. The building at 549 rue Baume has more than doubled the value of the property in three years, going from $90,200 to $202,400. The Pontiac Community Radio building, CHIP 101.9, also saw a dramatic jump, going from $359,100 to $649,000. 517 rue Baume, the site of the former Hotel Pearson, had an astonishing increase $186,100 to $964,000.

Reached by phone, MRC Pontiac Director General Bernard Roy said that major adjustments should be made to the website for this purpose.

Following the publication of this story, Roy reached out to CHIP 101.9 on Friday afternoon. While the story had originally characterized the discrepancies as “errors”, Roy said that the term was inaccurate. He said that there were corrections to be made to the assessment roll. The nature of these corrections remains to be specified.

The property assessment service of the MRC Pontiac is responsible for preparing and updating the assessment rolls of the 18 local municipalities and the TNO. FQM-Évaluation currently provides this service for the MRC Pontiac. More details on this case should be known in the coming days.

What is the assessment roll?

The assessment roll indicates the value of each property on the basis of its real value or its exchange value in a free market. In other words, it is the most likely price that a buyer would pay for a property. The value forms the basis for calculating municipal and school taxes, and is updated every three years.

Requesting a review

According to the MRC’s website, a review of an assessment must be requested by May 1 in the first year of the three year roll. In the event that changes to the property warrant a new assessment outside of this timeframe, only the changed items are eligible for re-assessment.

“If you disagree with the assessment of your property, we recommend that you consult with our appraisers before initiating a formal review process to avoid unnecessary and costly steps,” the site states.

The form to initiate the process is available here.

The price list by valuation is as follows:

Less than $500,000 – $75

Between $500,000 and $2 million – $300

Between $2 million and $5 million – $500

Over $5 million – $1,000